Interest

Us desire to pick property of our own, a residence in regards to our group, and a place that is the ongoing from changes away from existence. Yet not, buying property is a significant financial decision, one which means good-sized believe and you may planning. Not just want to find out your home loan finances and find best homes assets yourself plus household members, however you also have to determine the reason of funding towards cost of the house. That is where a mortgage will come in!

On the supply of structured and easy mortgage brokers at feasible costs, its simpler to plan the purchase from a house one suits your financial allowance and needs. You could assess the feasibility of the various mortgage selection available for you with the help of a mortgage EMI Calculator. Just like the home loans are usually repaid when it comes to Equated Monthly payments (EMIs), the above mentioned equipment is a fantastic solution to find out exactly how much currency you shall must arranged each month with the installment of your house loan.

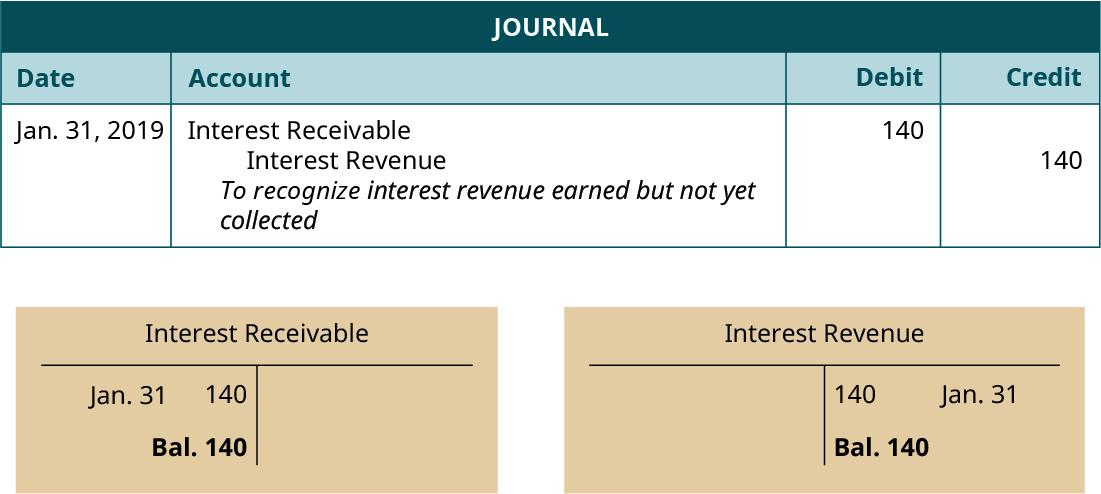

There are two main big elements of the new fees off a property financing, namely the primary while the interest. Into the initial phase of one’s payment in your home loan, a major proportion of EMI try constituted by focus toward financing, whilst in the later stage, it’s the dominating one to comprises a majority of the fresh new EMI.

Facts One to Dictate Financial EMI

- The main amount sanctioned toward loan

- The rate of interest towards home loan

- The tenure of the financing

Ideas on how to Assess Home loan EMI Playing with Our EMI Calculator

You are able to Piramal Realty’s Mortgage EMI Calculator to calculate the new EMI payable for your house loan. You really need to go into the following the details to reach it value:

- The amount of your house financing required by you

- New period of the property financing you should go for

- The newest appropriate financial rate of interest

Advantages of choosing A keen EMI Calculator To own elitecashadvance.com fixed rate personal loans A mortgage

You will find some benefits of using home financing EMI Calculator. Information about how this unit can help you in the process of your acquisition of your house:

- It assists you’ve decided how much cash to help you use:Home financing EMI Calculator normally enable you to regulate how much in order to use, keeping in mind what you can do to repay the borrowed funds. You can test certain combinations of your number of the borrowed funds in addition to financing period so you’re able to fetch different EMIs, upcoming choose the integration that’s the most possible for your. By doing this, you can remember to do not capture home financing that’s outside of the economic ability to pay off.

- It assists you decide from where so you can borrow:By using home financing EMI Calculator, you might examine your house money available by additional banking companies and decide which one was most suited for the economic standards and you can finances. That it do so helps you pick the best home loan to possess yourself.

- It will help your regulate how to repay the borrowed funds:Brand new quality regarding mortgage EMI you ought to pay-off plus the tenure over you should make the fresh percentage makes it possible for that draft a financial plan to have the ability to honour these types of monetary obligations. You could evaluate their other obligations and see an agenda to fulfill every one of them, such as the EMI. Such a method to your finances is also inculcate a top knowledge off financial punishment on the conduct.