A national program is actually making it less expensive getting Native People in the us to buy a home, in the current higher-rates ecosystem.

Doing ericans who get a property or supply domestic collateral owing to this new Area 184 Indian Home loan Guarantee System are certain to get an excellent straight down payment than they will had prior to, said Karen Heston, elder home loan banker that have BOK Economic Mortgage during the Oklahoma.

That is because the program was eliminating the latest yearly loan be sure fee, and this earlier was one to-one-fourth out of a percent. For an excellent $200,000 home loan, which is a discount from $41 1 month (totaling nearly $five-hundred a-year), Heston explained.

While doing so, the program is reducing the initial mortgage guarantee payment you to definitely borrowers pay from a single.5% to 1%. That means borrowers will actually become funding below whatever they was in fact before, to produce a small difference between fee, nevertheless the big variation is on the yearly percentage are got rid of, she indexed.

These the brand new change take the top present experts you to Section 184 loans render so you’re able to Indigenous Americans such as for example less down payment. This all assists the brand new debtor have an overall total lower commission having limited amount of money up front, Heston said.

Point 184 financing come no matter current home loan pricing and serve as an indication one targeting rates alone can mean overlooking most other real estate gadgets that notably impression the month-to-month payment, masters said.

Even in the event you’re sure you qualify for a part 184 financing, you can find inquiries you really need to pose a question to your loan administrator:

“Consumers are definitely asking in the pricing, however, in addition important than ever before is that i meets individuals to your correct system in their eyes,” informed me Heather Drummond, elder manager out-of neighborhood business innovation for BOK Economic.

“We should instead discover where you-the new borrower-want to be as much as commission is concerned as well as how far you must lay out,” she went on. “This is why it is very important to go over such issues upfront.”

Such as, unlike very first-day household customer points, there is absolutely no earnings restriction getting a paragraph 184 financing, indexed Elvira M-Duran, home financing banker which have BOK Financial Home loan within the Brand new Mexico.

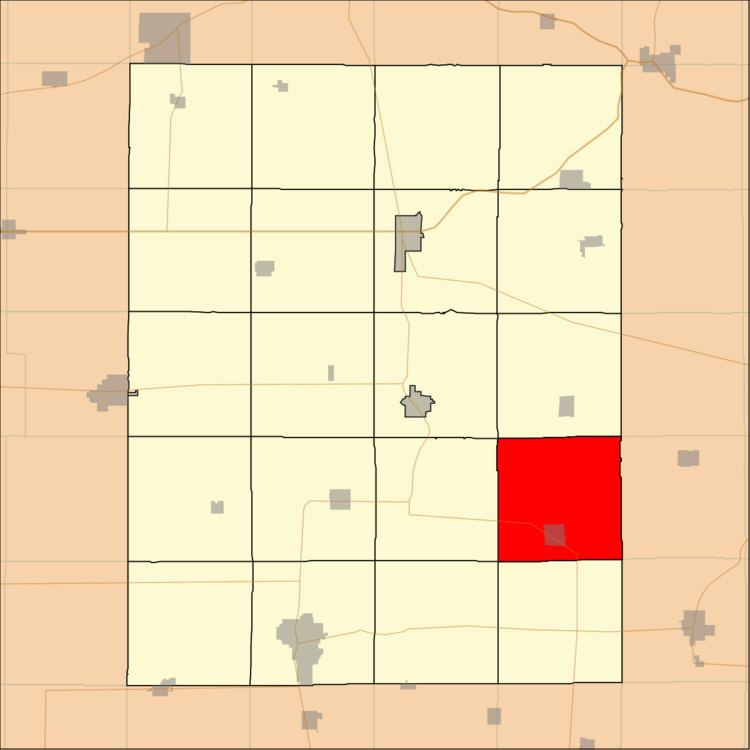

In certain says, such as for example Tx, only a few counties are eligible. Various other claims-such as Oklahoma, Washington and you will Texas-all the counties are eligible. loans Nixburg An entire list of acknowledged credit portion exists into the HUD webpages. To help you be considered, you must be an american Indian or Alaska Indigenous who’s a person in a federally recognized group.

Another type of well-known misconception would be the fact Point 184 finance can just only getting always get a property. “This product isn’t just for buying,” Duran explained. “Current homeowners may also refinance having debt consolidating, remodeling, bringing cash back or reducing their speed.”

Such as, a standard myth is because they can just only be studied to the tribal believe belongings, that’s no longer your situation, Duran told you

- Does the mortgage need to be distributed to have governmental approval? BOK Economic is the most only a few lenders able to accelerate the method of the giving Part 184 funds on the part of HUD, in place of giving files so you can HUD for recognition. “I am with my borrowers ahead of, through the and even following closing,” Heston told you.

- Just how experienced could you be which have Section 184 money? For more than 25 years, BOK Monetary has already established official Indigenous Western home loan officers whom try experienced with the initial Point 184 mortgage standards and you may recognition processes.

- Is also the borrowed funds be studied together with other recommendations apps? Assistance is possibly provided by tribes and states that offer down commission guidelines. In these instances, the support is sometimes used in scam.

- Are a part 184 financing the best product for my situation? Even if Point 184 funds are usually the best option to have qualified individuals, there are lots of times-like when an individual has a top credit rating and lower income-where a normal mortgage is a far greater match, Drummond said.

- Do my co-debtor should be Local, as well? Zero. Regardless if their co-borrower is not Local, their earnings commonly however implement.

“We need to make sure all of our members and regional Native teams know about this type of potential, particularly if this means bringing individuals within their basic family,” Drummond told you.