Fixed-Price Mortgage: a home loan that have money that continue to be a comparable in the lifetime of the financing while the rate of interest or any other terms and conditions was repaired and do not change.

Flooding Insurance rates: insurance policies one to protects people up against losses out-of a flood; when the a home is found in a flooding basic, the lending company will require flood insurance coverage before approving financing

Forbearance: a loan provider may pick to not simply take suit when a beneficial borrower was later to make an installment. Usually this occurs whenever a borrower creates plans you to definitely each party agree provides overdue mortgage repayments high tech.

Freddie Mac computer: Government Financial Home loan Enterprise (FHLM); an excellent federally chartered corporation you to definitely sales home-based mortgages, securitizes all of them, and you may offers these to dealers; this provides you with lenders with finance for new homebuyers. Also known as a government Sponsored Firm (GSE).

Front Proportion: a share researching a good borrower’s total month-to-month rates to invest in a great household (financial dominating and you will desire, insurance, and you will a residential property taxation) to help you monthly money before write-offs.

GSE: abbreviation to possess bodies backed people: a couple of financial qualities organizations molded by United states Congress to reduce interest levels to own growers and residents. Examples include Federal national mortgage association and Freddie Mac computer.

Ginnie Mae: Authorities Federal Home loan Association (GNMA); a federal government-possessed business administered by the You.S. Service from Housing and you may Urban Development, Ginnie Mae swimming pools FHA-insured and you can Virtual assistant-guaranteed loans to help you back securities getting individual funding; as with Federal national mortgage association and Freddie Mac computer, the capital income brings resource which can next be lent to help you qualified borrowers by the loan providers.

Global Financial obligation Studio: made to ensure it is investors in the world to order financial obligation (loans) away from U.S. buck and you may forex through a number of clearing solutions.

Good-faith Imagine: a price of all of the closure costs including pre-reduced and you can escrow issues and additionally financial charges; should be given to the new debtor within this three days once submission away from a loan application.

Finished Fee Mortgages: mortgages you to start with lower monthly obligations which get reduced larger during a period of many years, eventually getting together with a predetermined top and you may remaining there toward lives of your own financing. Graduated commission money is an excellent for those who predict their annual money to boost.

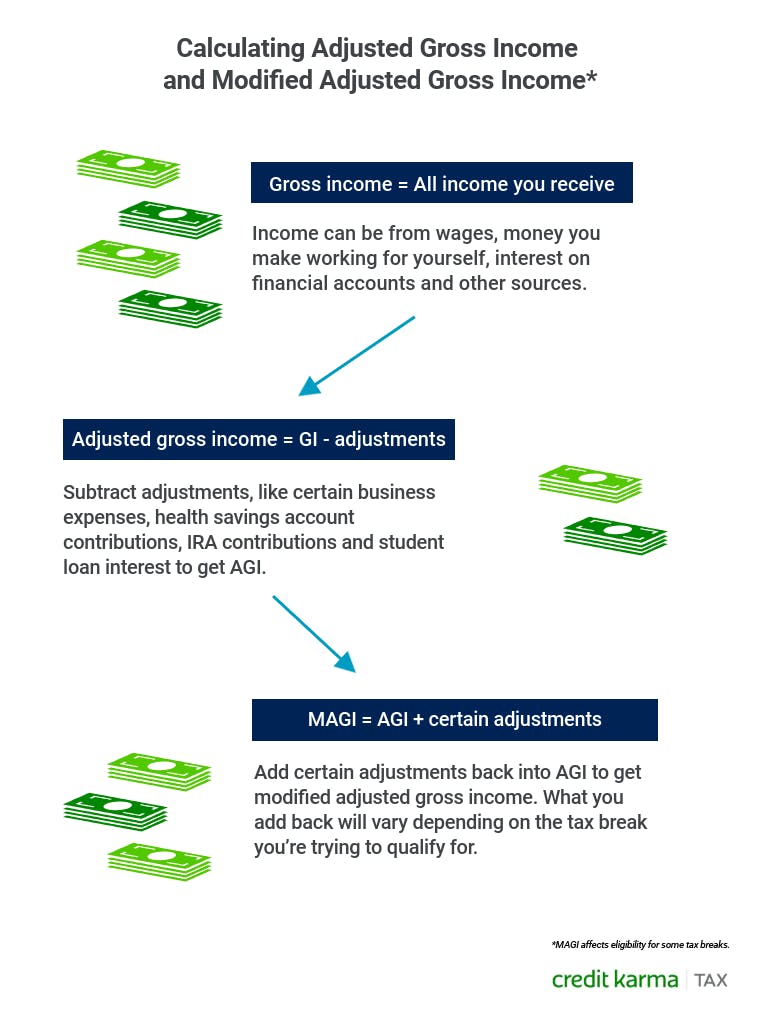

Gross income: currency made ahead of taxation or any installment loans no bank account Dallas other write-offs. Often it start from money from mind-a position, local rental assets, alimony, child service, societal assistance payments, and you can retirement benefits.

Guarantee Percentage: payment to help you FannieMae regarding a loan provider on assurance out-of fast prominent and you can attract costs to help you MBS (Mortgage Supported Safety) cover people.

HECM (Contrary Financial): the reverse mortgage can be used of the senior home owners age 62 and you will earlier to transform brand new security in their home with the month-to-month streams cash and/or a credit line to get reduced once they zero offered reside the house. A loan company including a mortgage lender, bank, borrowing union otherwise offers and you may financing relationship loans the latest FHA covered mortgage, popularly known as HECM.

Household Collateral Line of credit: a mortgage loan, constantly within the next financial, enabling a debtor to acquire bucks contrary to the guarantee out-of a beneficial house, up to a predetermined count

Issues Insurance coverage: coverage against a specific losses, such flame, wind an such like., during a period of time that’s protected from the percentage of a frequently planned superior.

HELP: Homebuyer Knowledge Learning System; an educational system regarding the FHA you to counsels some body regarding property process; Assist discusses subjects instance cost management, seeking a property, delivering that loan, and family restoration; more often than not, completion of program could possibly get entitle the newest homebuyer to help you a reduced initially FHA financial top-of 2.25% to one.75% of the home cost.