Dream2Own Often Expand Financial Use of Underserved People

Chi town, VyStar Borrowing from the bank Partnership, new 13th premier credit relationship in the nation, and TransUnion (NYSE: TRU) has forged another relationship to promote a lot more monetary addition inside the the mortgage market. VyStar commonly influence TransUnion and FinLocker study through its most recent unit, Dream2Own TM , to better suffice the professionals during and long before the loan processes, leading to a whole lot more homeownership options.

VyStar Lovers with TransUnion and you will FinLocker to improve Home loan Addition Whenever you are Mitigating Risk

TransUnion and you can FinLocker offer end-to-prevent selection to own mortgage originators and you may business one to increase customers acquisition and you can preservation whenever you are bringing economic well-being tools in order to present consumers and you may prospects.

VyStar is actually happy to possess chose TransUnion and you can FinLocker just like the number one couples within upcoming financial monetary health equipment Dream2Own, said Jennifer Lopez Kouchis, Head Financial Banking Officer at the VyStar. VyStar signed the borrowed funds Bankers Organization Home for all Guarantee into the 2022. We believe Dream2Own will assist VyStar with its pledge to bring financial independence and increase mortgage addition because of the appointment all of our professionals in which he or she is, about groups where we suffice. As well, broadening our very own started to to simply help coming members.

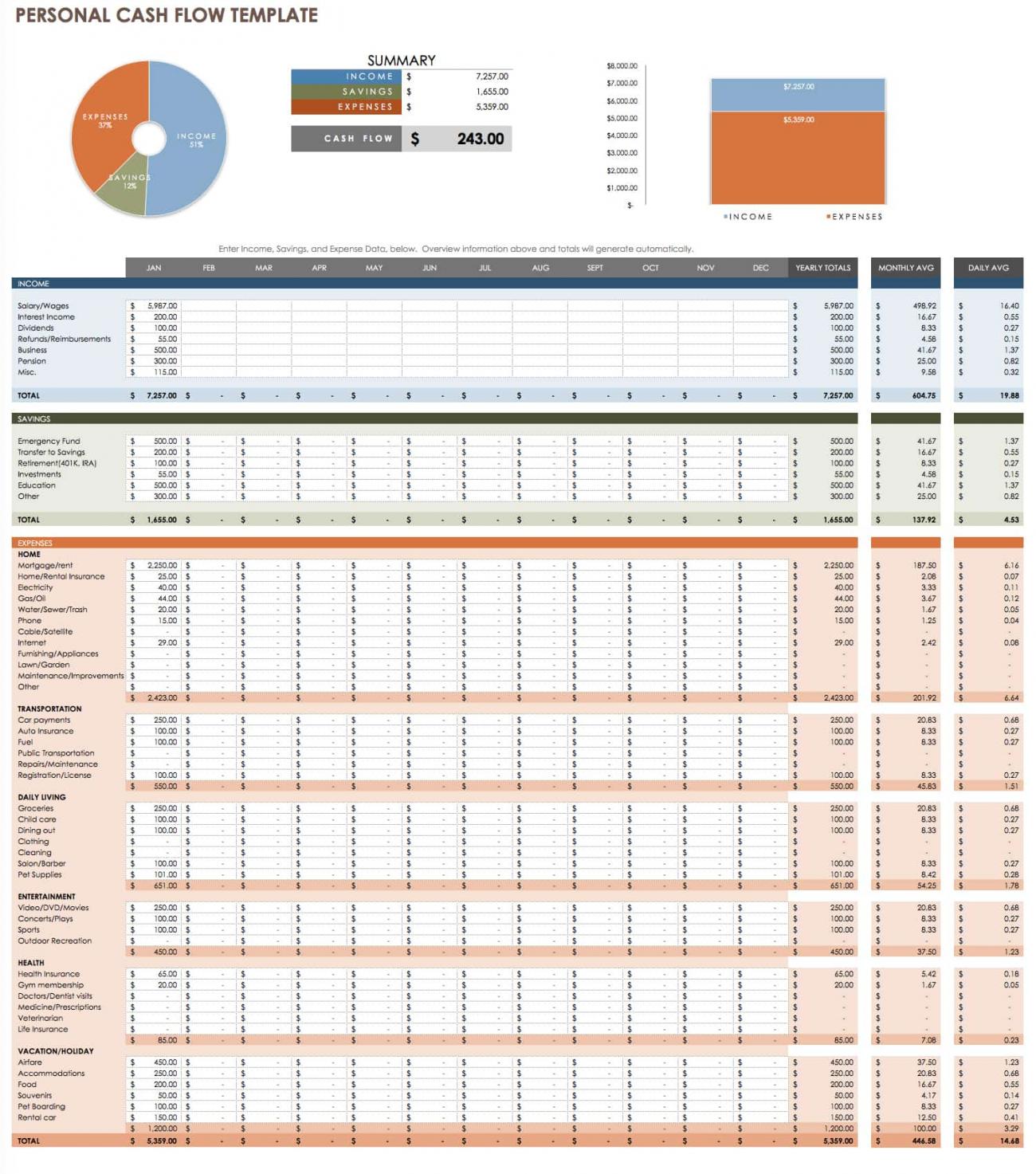

Including gurus open to originators and you will business, these TransUnion and FinLocker choices bring tools one yourself benefit possible home owners, lots of whom have already exhibited an incredible importance of significantly more to acquire techniques understanding. The various tools bring potential homebuyers, many of if not underserved groups, home loan and you may homebuying academic tips, credit monitoring, obligations administration, budgeting, and you will considered pointers that can help reduced- to help you modest-money customers realize their think of homeownership.

I look ahead to integrating that have VyStar to assist do customers and you may candidates out-of end in funded financing. Such digital choices can assist boost the VyStar member experience, reduce the cost of loan production, and you may push efficiencies in mortgage servicing while you are creating more options to possess VyStar professionals to help you safer a home loan.

https://paydayloancolorado.net/gold-hill/

Playing with TransUnion and you can FinLocker options, individuals will likely be led within their novel trip towards homeownership, told you Henry Cason, Chief executive officer, FinLocker. Of the merging its financial information under one roof, pages can merely tune the security, obligations, and you may using and constantly discover where they stand-on the goal off financial readiness. The technology lets profiles remain on most useful of their credit history due to a mellow eliminate. It includes more devices for example borrowing from the bank simulator, providing worthwhile service from the homeownership processes.

TransUnion is an international information and information company along with twelve,000 partners working in more than just 30 regions. I build trust you can easily by the ensuring different people was reliably depicted around. I accomplish that having good Tru image of different people: an actionable look at users, stewarded with care. Due to all of our purchases and you may technical financial investments we have developed imaginative choices you to continue beyond the solid base during the key borrowing from the bank into portion such as business, scam, exposure and you can cutting-edge statistics. Thus, people and you will organizations is also interact with confidence and you will achieve high anything. We label this article forever – therefore results in economic possibility, higher enjoy and personal empowerment getting many people around the globe.

FinLocker provides a safe financial physical fitness software you to definitely aggregates and you can assesses a consumer’s economic studies giving hyper-custom excursions to build and display screen its borrowing, create its financial accounts, get in touch with a property affordability calculator, create wants, finances and cut to achieve mortgage qualifications getting a mortgage and you will almost every other financial desires. Consumers playing with good FinLocker app is also realize their advances to your financial maturity just before pre-degree which have FinLocker’s Homeownership Snapshot, begin their property look, and you can shop private and financial documents, which will be safely shared with its mortgage administrator straight from the latest app to start the application for the loan. Mortgage brokers and you can economic companies can be white-name FinLocker to draw, let and you will move leads, get market share, lose financing handling costs, treat rubbing, and build users for a lifetime. To learn more, head to FinLocker .