An increasing number of individuals are taking out a small-identified sort of financial that allows these to buy a property without the need to set out in initial deposit.

Numerous lenders render concessionary pick mortgage loans, which means a tenant can acquire the home he could be way of living within the using their property owner at the a marked-off price.

There have been a rise in just take-upwards because the income tax change into pick-to-lets and much highest home loan will cost you prompt more landlords to offer. Today TSB, among loan providers that offers these product sales, accounts extreme consult.

Its moved regarding a product or service i never really talked planning to something that continuously comes up. We’re carrying out a stable matter … there is a demand because of it, claims Roland McCormack, TSB’s home loan shipments movie director.

Getting tenants considering the chance to buy like that, it can be an educated financial package he could be ever before offered. Although it requires a landlord agreeing to take a lower life expectancy rate than simply they could possibly get on the latest open market, in addition function a faster, easier income with no house broker charges.

A lot of banking companies and you can strengthening societies provide mortgage loans that enable you to definitely buy children member’s assets for under the ple, when a daddy desires to let their child to the possessions steps, thus agrees to sell during the a low price.

But not, specific loan providers in addition to deal with home loan apps from seated clients attempting to purchase from their property owner, and you will out of staff wanting to buy from its boss.

Crucially, the vendor typically has so you can commit to sell for no less than 10% below its market price. Of a lot landlords will dsicover that hard to take. not, owner will delight in benefit one, its advertised, you certainly will offset approximately half of this loss.

In lot of, yet not all of the, cases, the latest occupant does not need to lay out a penny out of their own bucks as in initial deposit for the mortgage-cam, the newest property owner are providing the tenant a present out of guarantee, which is drawn by financial since the a deposit. And when a beneficial 10% write off, the consumer carry out next take out a beneficial ninety% loan-to-worthy of (LTV) home loan.

not, the customer may decide to installed a number of their unique money to boost the newest put and you may lower the newest LTV, and that we hope will give all of them access to a far greater speed.

Landlords which offer through a great concessionary buy would lose out on rates, but take advantage of a soft, short sale without house agents’ charges or perhaps the will set you back of obtaining an empty assets to possess days. Photograph: Andy Precipitation/EPA

And that finance companies otherwise lenders provide this type of revenue?

Terminology can vary. Such as, TSB and you may All over the country is among those that clearly state they perform not want the newest occupant to place off any put. However, each other Barclays and NatWest say people need lead their deposit on top no less than 5%.

Usually, this can be gonna be a plan between a personal landlord and you can tenant, though TSB and you may Halifax say the property owner can also be a beneficial regional expert, showing this is often an option for a great council renter in which the ability to get isnt offered.

Why must a property manager agree to accomplish that?

A mix of a faster beneficial tax routine for pick-to-assist characteristics, and you will a set out-of mortgage-price rises during the last 2 yrs, possess resulted in of several landlords baling out from the leased sector or contrasting the options. Generally there will definitely getting specific that happen to be enthusiastic to market.

By the selling on their tenant, they stop make payment on will set you back generally in the property income significantly estate representative charges, that can start from lower than step 1% to as much as 3.5%. it form they won’t become spending perhaps several months regarding financial appeal once the home is empty as well as on new industry.

McCormack reckons these two coupons commonly in place slice the amount the newest property manager is giving away from ten% in order to similar to 5%. He could be nonetheless up front, but it’s a much simpler transaction in their eyes, he contributes. They don’t have for a tenant get out of your own property, do everything up-and after that wait several months the without receiving rent.

At the same time, the fresh new property owner need not annoy wanting a buyer and you can writing on a lot of questions concerning the assets.

Among the many secret pros for a property owner may be the rate away from a-sale, and you can, probably, they will not want to do a disservice in order to a renter just who has maybe started life there for quite some time, says David Hollingworth of broker L&C Mortgage loans. In the event the landlord has made a beneficial ount regarding the assets and you will has actually a connection with the newest renter, they may like the notion of permitting them be a homeowner.

Together with, they understand the home and town, says McCormack. They know the fresh new heating performs, they understand brand new area, they are aware brand new problems and they understand neighbours.

An excellent landlord’s ?29,000 gift’

First-date customers Graham and you can Lisa acquired a large economic providing hand discover into houses hierarchy when it comes to a ?29,000 security gift off their property owner to order the home that they had started life style set for over three years.

They started renting the 2-rooms cottage near Cheltenham during the late 2019, right after which, early just last year, the new property owner told you he was seeking to offer.

The couple, who were thinking of seeking to find the assets, spoke to help you a home loan agent which ideal a great TSB concessionary purchase home loan.

The happy couple made certain brand new terms was basically Okay into the landlord in particular, the new 10% dismiss. The guy assented, in addition they went in the future.

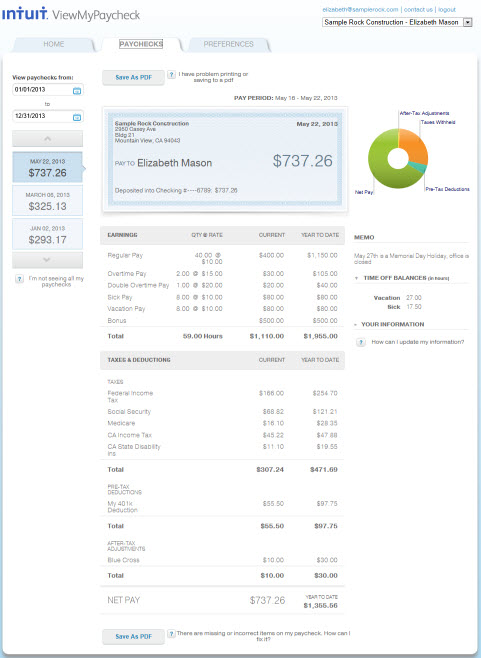

I set up an alternate ?20K, so the deposit is actually ?51,000, states Graham, thirty-two. One to intended they might take-out home financing (an effective four-seasons enhance) for ?259,000.

This might be probably the best way we could have got into brand new ladder, says Graham, a launch professional doing work in aerospace. The couple failed to have to move or take on other customers or manage some of the really difficult parts of housebuying.

He’s purchasing more monthly than just they certainly were after they was basically leasing. not, it is to your a home loan, and the house is ours. Of http://clickcashadvance.com/personal-loans-wa/hamilton course, we’ve got ?30K out of guarantee i don’t pay for, claims Graham.